Payroll outsourcing

Payroll processing simplified

Cezanne’s outsourced payroll service takes away the headache of payroll processing without expecting you to sacrifice control over your payroll data and HR processes.

That’s because Cezanne’s payroll outsourcing service combines the best of both worlds: a secure, flexible and easy-to-manage HR software system backed by a team of payroll experts who manage your payroll processing for you. You get all of the advantages that come with using an expert payroll service, without the loss of visibility and control over your data associated with traditional payroll outsourcing services.

What is outsourced payroll?

Outsourced payroll refers to the practice of using a specialist company to manage the administrative and compliance activities associated with paying your employees. Sometimes described as managed payroll, an outsourced payroll service provider ensures that payroll is processed smoothly and securely, and in line with legislation.

Outsourced payroll providers, like Cezanne HR, employ payroll professionals whose role it is to stay up to date with payroll legislation and compliance requirements, and manage your payroll function for you.

Why choose Cezanne HR for outsourced payroll services?

Established in 2013, Cezanne is a leading UK-headquartered supplier of integrated HR software and payroll outsourcing services.

Trusted by thousands of HR and payroll professionals, Cezanne supports organisations across virtually every sector, from finance and legal services through high tech, biotech and logistics to charities and education management.

Book your online demo today

How can I achieve seamless integration with outsourced payroll?

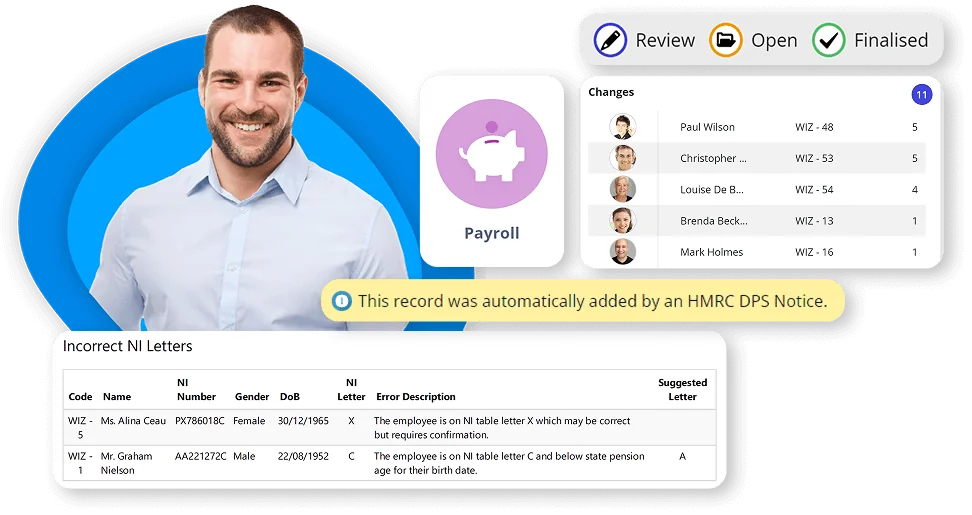

Cezanne’s payroll software combines the expertise of our in-house payroll team with the power of Cloud HR technologies to ensure that every aspect of your payroll processing runs smoothly. It uses the data you already have in your Cezanne HR software, and the rules you set (such as company-defined sick pay) to calculate pay entitlements, create reports and generate payslips for your employees. Information doesn’t need to be re-entered, sensitive employee data is kept safe and under your control, and your employees always know where to go to get their latest payslips.

What do our comprehensive outsourced payroll solutions include?

When wouldn’t you outsource your payroll?

Not every organisation is comfortable outsourcing their payroll processing to a third party. That’s understandable when HR or finance teams don’t have a single, accurate source of pay-related data to rely on. If data has to be compiled from multiple sources, it’s too easy for errors to creep in; new joiners get missed, updates to tax codes are overlooked, timesheets aren’t submitted, or leavers don’t get processed properly. In this situation having an inhouse team on hand to check the data is essential.

However, with Cezanne’s payroll outsourcing services that disappears. That’s because all the data needed to accurately process payroll – from time off and timesheets to tax codes and new joiner and leaver data – are managed in a single system.

How does an outsourced payroll service work?

As your managed payroll provider, we’ll automatically take the data needed to process your payroll from your Cezanne HR system. This includes information about your employees, such as their name, hire or leave dates and bank details, as well as relevant data from Cezanne’s absence management and timesheet modules. Our UK-based team of payroll experts then uses that data to process your payroll and generate the reports required by HMRC and yourselves – as well as upload payslips or other statutory documents to individual employee records. We are also able to manage pay processing if required.

How will my business benefit from outsourced payroll?

-

Time savings

Managing even a relatively simple payroll process is often time-consuming, especially if your inhouse team lacks the necessary expertise to quickly and easily resolve all of the queries that inevitably arise. An outsourced payroll service takes on all of the admin overhead, freeing up your own staff to focus on higher value activities, and is also better equipped to solve any payroll issues faster.

Alongside optimising staff overheads, payroll outsourcing helps prevent costly errors that may occur if employees lack the appropriate knowledge – or time.

-

Cost savings

For many organisations, the cost of employing and retaining payroll professionals is a significant financial overhead, which is driving the adoption of today’s more modern and affordable outsourced payroll outsourcing services.

-

Payroll compliance

Payroll regulations and tax laws are complex, and it can be difficult to ensure all of the rules are followed and deadlines met. Outsourcing payroll to a specialist provider can help ensure compliance with these regulations and avoid costly penalties.

-

Payroll accuracy

Payroll outsourcing companies have experience of handling every kind of payroll issue – from missing data relating to new starters to updates to deductions, sick pay and pension contributions. They can often spot and resolve data anomalies before they become an issue. This can help businesses avoid mistakes and ensure accurate payroll processing.

How can I assure data security in outsourced payroll?

Payroll information contains sensitive data, such as employee contact information, NI numbers and bank account details, that organisations have a legal responsibility to keep safe. Outsourcing payroll to a company that is trained in handling confidential information helps protect against security breaches.

With Cezanne’s managed payroll services, all of the sensitive data required to process payroll can be managed in your Cezanne HR system. You’ll never have to worry about the risk of sharing sensitive data with third party providers via Excel spreadsheets or data upload facilities.

Cezanne’s security features include:

- Advanced role-based security

- Secure passwords

- 24/7 monitoring

- Third-party penetration testing

- ISO27001 certified for both our technology and support services

- GDPR compliance (UK & EU)

- Secure hosting with AWS

Let’s transform HR together

To learn about Cezanne’s integrated HR software and outsourced payroll service, get in touch today.

Answers to common questions about Cezanne’s outsourced payroll services

Who is Cezanne HR’s outsourced payroll service best for?

Cezanne HR’s outsourced payroll service is best for mid-sized companies with employees in the UK (including Scotland and Wales) looking for an integrated HR software and payroll processing solution.

Organisations that use Cezanne HR’s payroll outsourcing solution typically range in size from SMEs with under 100 employees to larger mid-sized businesses. All are looking to enhance their payroll function by combining the benefits of Cezanne HR’s comprehensive HR system with the expertise of our payroll professionals.

How frequently can you process payroll?

We manage monthly, every four weeks, fortnightly or weekly pay runs, together with multi-company and multi-schedule payroll processing.

Why choose Cezanne HR for payroll outsourcing?

The main reasons why customers choose Cezanne HR’s payroll service is because it is flexible and cost-effective, ensures data accuracy and compliance and saves them time. Customers also benefit from much better control over their data, extensive reporting and easy employee self-service access to payslips and other important information.

How do I get started with outsourced payroll?

If you are already using the Cezanne HR system, just get in touch with your account manager. They’ll be happy to introduce you to our payroll team, who can explain the service to you. If you are yet to see the Cezanne HR system, click here to arrange an online demo with one of our friendly product experts.

What are fully managed payroll services?

Fully managed payroll services refer to a comprehensive payroll outsourcing service that covers all of the pay-related activities required to ensure employee are paid accurately and on time, and in line with legislation. The definition of a fully managed payroll service covers the core aspects of payroll processing, including calculating statutory payments and deductions, delivering payslips to employees and generating the reports required by HMRC. Some payroll services may also include additional services, such as automatically calculating occupational sick and parental pay based on company defined rules, payment processing and the management of pension auto-enrolment. The benefit of a fully managed payroll service is that your complete payroll function is the responsibility of a single company, avoiding the risk of data disconnect and communication issues.