UK PAYROLL MADE EASY

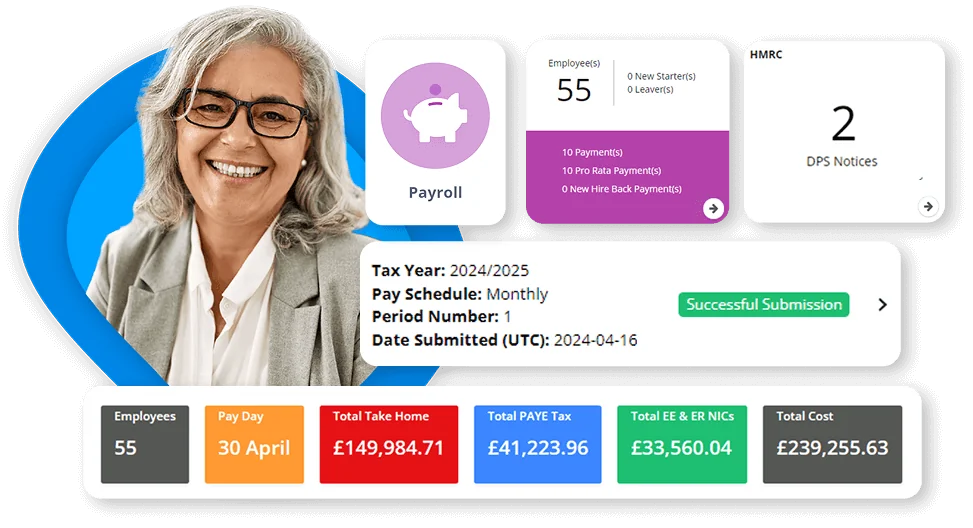

Fast and accurate payroll processing

Forget out of sync data, complicated manual pay calculations and keeping up with ever-changing regulations… Cezanne’s HMRC-recognised software couldn’t make UK payroll simpler!

Configurable dashboards save you time, reduce stress and give you all the data you need right at your fingertips. From validating employee data and reviewing deductions to generating statutory reports and payslips – run everything smoothly and efficiently all from one place.

Learn more

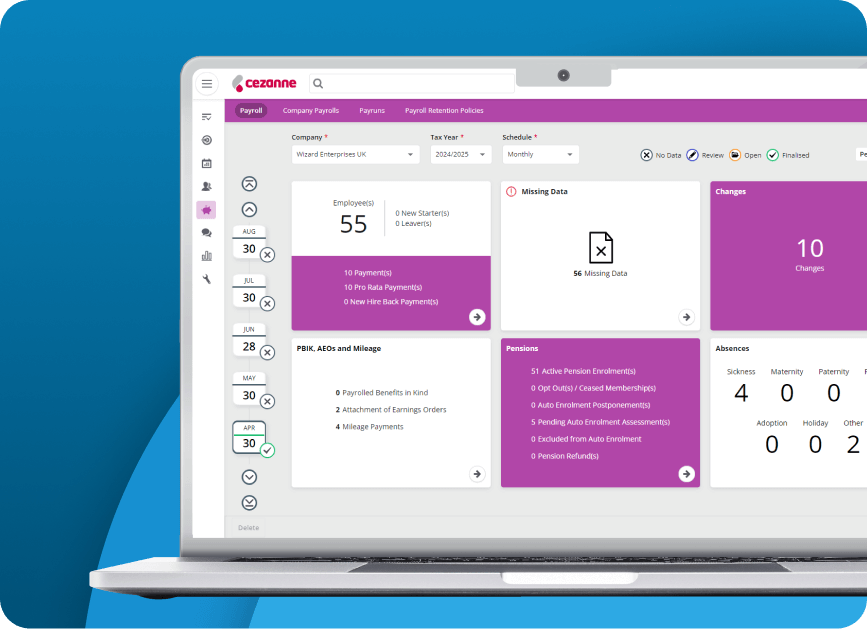

NATIVE HR AND PAYROLL SOFTWARE

Seamlessly sophisticated

Finding payslips, P60s or P11Ds is intuitive and easy for employees using Cezanne’s secure cloud software. And, unlike some other HR solutions that offer mere payroll integrations, our payroll software is native to the Cezanne HRIS. So, no clunky 3rd party integrations or manual file transfers here!

Our native payroll solution – built on our proven HR software architecture – offers seamless and real-time data transfer: including personal data changes, timesheet & attendance, payslips and much more…

Learn more

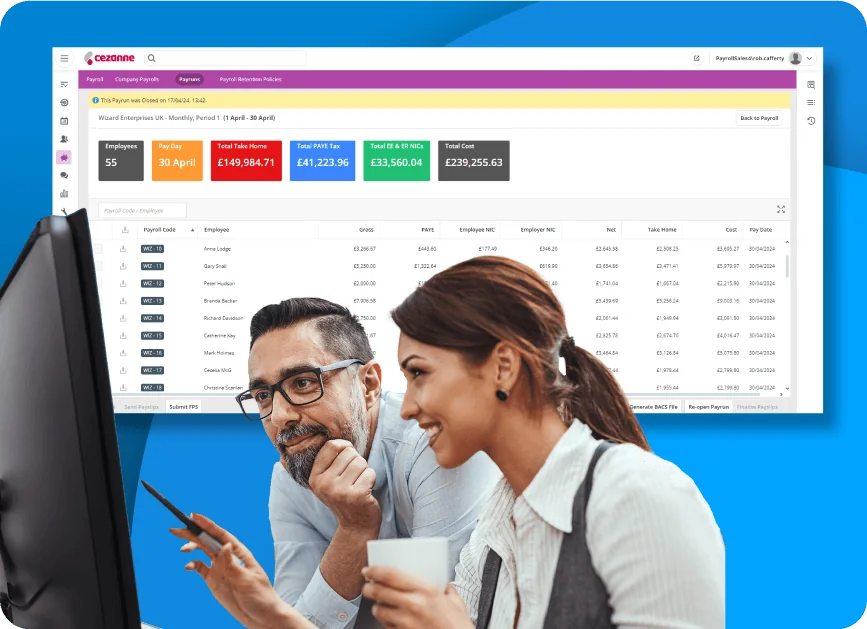

HMRC-RECOGNISED

HMRC compliance you can count on

Our software is HMRC-recognised and RTI compliant: plus, with our payroll software, you’ll never have to check the accuracy of your tax codes ever again! Tax codes can be automatically downloaded from HMRC directly, with no other interventions required.

Better still, our software receives regular updates with the latest UK payroll regulations and updated calculation methods. This means you’ll always have the most up to date HMRC tax codes that ensures mistakes are a thing of the past.

Learn more

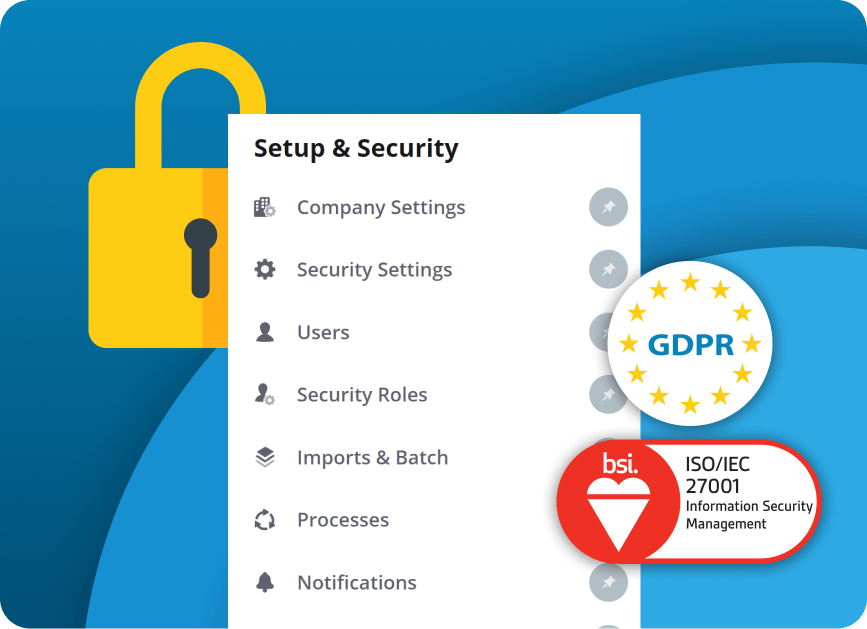

ADVANCED SECURITY

GDPR-compliant with user-based access, secure data feed and much more…

When you’re running payroll in-house, security and compliance aren’t optional – they’re essential. That’s why our native in-house payroll software is built with GDPR and TLS data protection at its core. It’s backed by the ISO 27001 security framework, Cyber Essentials certification, and FSQS registration, so you know we’re meeting the strict standards required for handling sensitive financial and personal data.

You can also customise user-based security levels, so only the right people see the right information. It’s just one more way we help you keep your HR and payroll data safe, compliant, and under control.

Learn more

We were looking for a payroll provider that we would consider our partners, with all the expertise and knowledge that we needed. With Cezanne HR, we’ve definitely got that partnership we were hoping for. Long may it continue!

Inspiration Healthcare GroupNovember 2023

ACHIEVE MORE WITH CEZANNE'S IN-HOUSE PAYROLL SOFTWARE

Everything needed to ensure in-house payroll processing runs smoothly

- Automatic updates via HMRC Data Provisioning Service (DPS)

- Verification of employee sort codes and account numbers

- Calculation of:

• Statutory payments and deductions including Maternity & Sick Leave

• Occupational Maternity Leave based on configurable rules

• Occupational Sick Leave based on configurable rules - HMRC RTI submission from within your all-in-one system

• FPS – Full Payment Submission

• EPS – Employer Payment Summary

• NVR – NI Number Verification Request

• EXB – Expenses and Benefits

- Gross to Net Analysis report (Payroll Run Details report)

- Pension reports

- CSV report detailing all payments required as a result of a pay run with BACS template to upload to your bank.

- Production of statutory reports: P11, P11D, P11D(b), P30, P32, P45, P60

- Make payslips, P60s and P11Ds available to employees within your Cezanne HR system

- Pension auto-enrolment assessment

- Easily generate Pension enrolment letters

- Configurable Journal with split cost centres to import to General Ledger. Year-end process including final RTI submissions for the tax year

Let’s transform HR and payroll together

Get in touch today to discover how you could benefit from Cezanne’s in-house payroll software.

More to explore

In-house Payroll Software is just part of our comprehensive suite of HR solutions. Why not explore all of the great modules available to you today.

In-house Payroll: FAQs

Is Cezanne Payroll Software available as a standalone item?

No. Cezanne’s Payroll Software is a native module of the Cezanne HRIS platform.

What is native HR and Payroll software?

A native HR and payroll software means a system that is built specifically for managing HR and payroll processing within a single platform. It is designed to handle tasks like employee data management, payroll processing, leave management, and compliance reporting without needing integration with other systems.

Can Cezanne’s payroll software make automatic deductions?

Yes indeed! Automatic deductions can be added for things such as season ticket loans, or bike schemes. These can also be paused if employee is on long-term sick, for example.

Can you add different levels of user authority?

Absolutely! Depending on user level authority, fields and certain screens can be hidden, so important data and information can only be viewed by those who need to see it.

Does Cezanne Payroll software include auto-enrolment for pension schemes?

Yes, it does! And, it’s calculated automatically depending on when an employee starts – meaning less manual work for you.

Can payslips be branded?

Yes, they can. You don’t even need the use of a developer – it can all be done within Cezanne’s Payroll software.

Can users perform manual overrides?

Yes, then can. These can be done for one-off payments (such as an expenses reimbursement), and the software also includes the ability to comment as to why for payments have been made for audit trail purposes.

Does Cezanne offer outsourced or managed payroll services?

Yes! Learn more about our managed payroll services here.