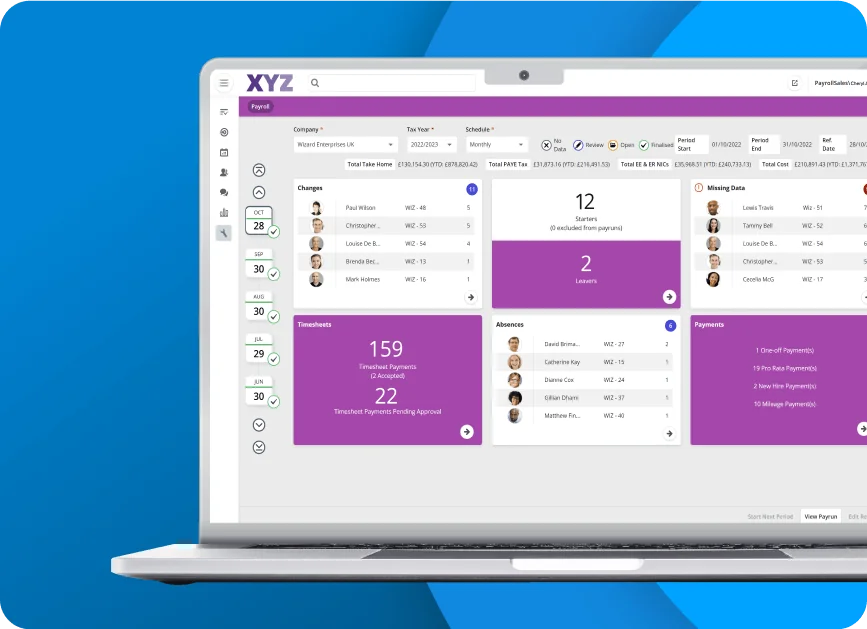

Payroll processing simplified

UK payroll made easy

Cezanne’s Smart Managed Payroll service makes running UK payroll simple. All you need to do is ensure the pay-related information in your Cezanne HR system is up to date. Our team of UK-based payroll professionals will take care of the rest, saving you time and delivering a service everyone will appreciate.

They’ll ensures every aspect of your payroll process, from validating employee data and calculating deductions to generating statutory reports and payslips, runs smoothly, and be on hand to answer payroll data questions or liaise with HMRC, if needed.

Book your online demo

We were looking for a payroll provider that we would consider our partners, with all the expertise and knowledge that we needed. With Cezanne HR, we’ve definitely got that partnership we were hoping for. Long may it continue!

Inspiration Healthcare GroupNovember 2023

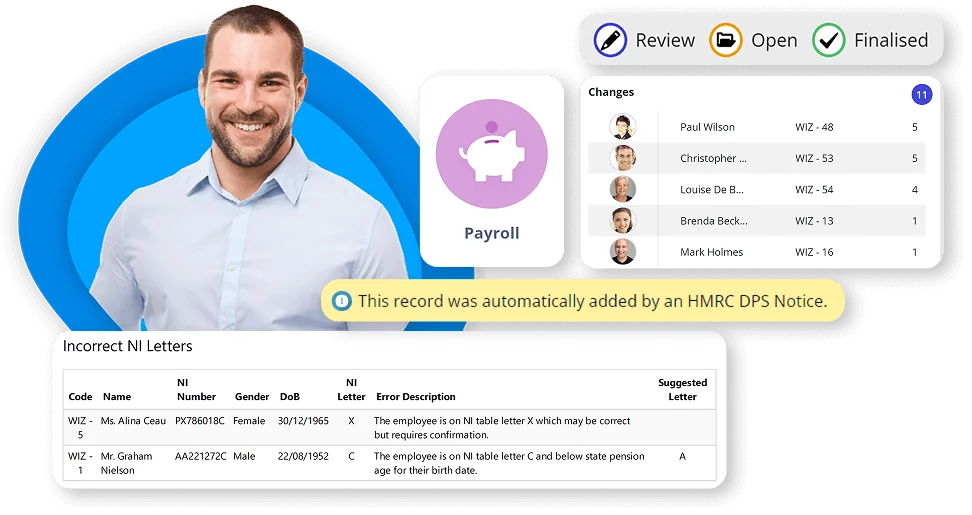

Integrated HR software and payroll

Seamless and secure

With Cezanne’s payroll outsourcing services, there’s no need to waste time re-keying data to send to a third-party payroll provider or extracting information to upload into a separate payroll solution.

Instead, you’ll benefit from the powerful combination of a flexible, easy-to-manage HR system that fits around your processes, and a smart, joined-up managed payroll solution delivered by our expert in-house team.

Learn more here

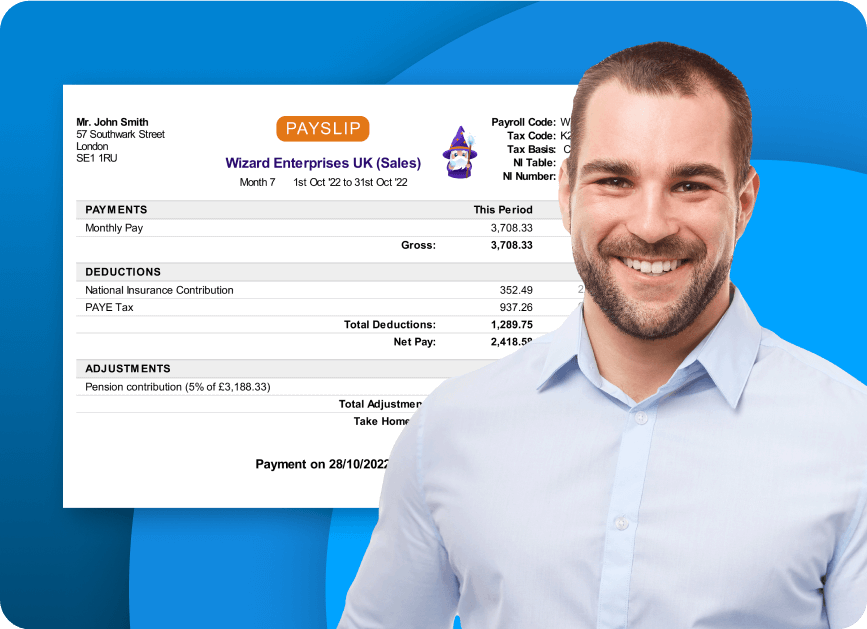

Online payslips

Better for everyone

With payslips and other important pay-related documents stored in your Cezanne HR system, Cezanne’s fully Managed Payroll service means your whole workforce gets a great service too.

Sensitive payroll information is kept safe, documents won’t go missing, and employees always know where to go to find their payslips, P60s or P11Ds.

Learn more here

Key service features:

- UK-based support team

- RTI ready

- GDPR compliant

- Reporting

- Monthly, every four weeks, fortnightly or weekly pay runs

- Multi-company and multi-schedule

- Calculation of statutory and company-defined parental and sick leave

- Pension auto-enrolment

- Payment processing (add-on service)

What Cezanne's Smarth Managed Payroll Service service includes

Everything needed to ensure payroll processing runs smoothly

Let’s transform HR and payroll together

Get in touch today to discover how you could benefit from Cezanne Smart Managed Payroll service.

More to explore

Smart managed payroll Service is just part of our comprehensive suite of HR solutions. Why not explore all of the great modules available to you today.

Smart Managed Payroll Service: FAQs

What is managed payroll?

What is managed payroll? Managed payroll refers to the outsourcing of payroll and management to a third-party provider. With managed payroll, the third party takes responsibility for calculating employee wages, taxes and deductions, generating the reports and data required by HMRC, distributing employee payslips and generating other pay-related documentation. Managed payroll providers, who may describe their services as outsourced payroll, payroll outsourcing or payroll services, may also assist with other activities, such as pension enrolment, payroll deductions and occupational sick pay.

What are the benefits of using a managed payroll service?

The main benefit of managed payroll service is that it avoids the challenges and costs associated with employing, training and retaining an in-house payroll team. Instead it provides companies with access to a pool of payroll experts who, because they support multiple customers on a regular basis, generally have a much greater depth and breadth of payroll knowledge. Payroll outsourcing takes advantage of external expertise to ensure employees are paid accurately and on time.

An added benefit of Cezanne HR's payroll outsourcing solution is HR and payroll data are held within Cezanne HR’s secure, GDPR-compliant payroll and HR system. This avoids the risks associated with emailing or inputting employee data into a third-party system and provides HR and business leaders with a single source of payroll and HR data, providing much greater visibility over important payroll information.

Who is Cezanne HR’s managed payroll service best for?

The managed payroll service is best for UK companies that pay their employees monthly, every four weeks, fortnightly or weekly, and are looking to outsource payroll processing service to payroll experts while still keeping control of other HR management activities. As the payroll service is integrated with the Cezanne HR software, it means HR teams can outsource labour-intensive payroll management without compromising the security or integrity of their HR data.

Why Cezanne HR for managed payroll?

Cezanne HR’s managed payroll service covers everything needed to streamline and simplify one of the most important activities your business needs to manage: paying your staff accurately and on time.

At Cezanne HR, we also put customer satisfaction at the heart of what we do. Our outsourced payroll services combine in-house payroll expertise with a passion for service excellence that is shared by every one of our employees and reflected in our approach. We don’t tie customers into long-term contracts or charge high set-up fees. In fact, our implementation service is provided free of charge as part of the monthly subscription service.

Will I lose control over my payroll if I outsource it?

No, you won't lose control. When you choose Cezanne HR's outsourced payroll services, you gain greater control and transparency. We provide you with access to real-time payroll reports and data, ensuring you have full visibility into your payroll data to give you peace of mind in the short and long term.

Cezanne HR’s managed payroll service covers everything needed to streamline and simplify one of the most important activities your business needs to manage: paying your staff accurately and on time.

Ensuring data security in managed payroll services

The Cezanne HR system and service is secure by design, and independently certified to ISO27001. We know just how sensitive payroll and HR data are, so have embedded security into our system and our services at every level.

We were looking for a payroll provider that we would consider our partners, with all the expertise and knowledge that we needed. With Cezanne HR, we’ve definitely got that partnership we were hoping for. Long may it continue!

Inspiration Healthcare GroupNovember 2023