HR software you and your team will love

Transform HR today with HR software built to streamline and simplify every aspect of human resources management, from recruitment and onboarding through core HR to performance reviews and payroll processing. Quick to implement and easy to manage, Cezanne HR is trusted by thousands of HR professionals in mid-sized UK and international organisations.

Comprehensive HR software suite

Smart for business, great for people

With easy online access, time-saving automation and flexible configuration options, Cezanne HR’s expert HR system makes HR work better for everyone.

It frees HR from repetitive tasks, converts data into meaningful reports, empowers line managers, ensures easy communication and connects employees with their information and each other, so everyone can work together more productively.

All-in-one HR system

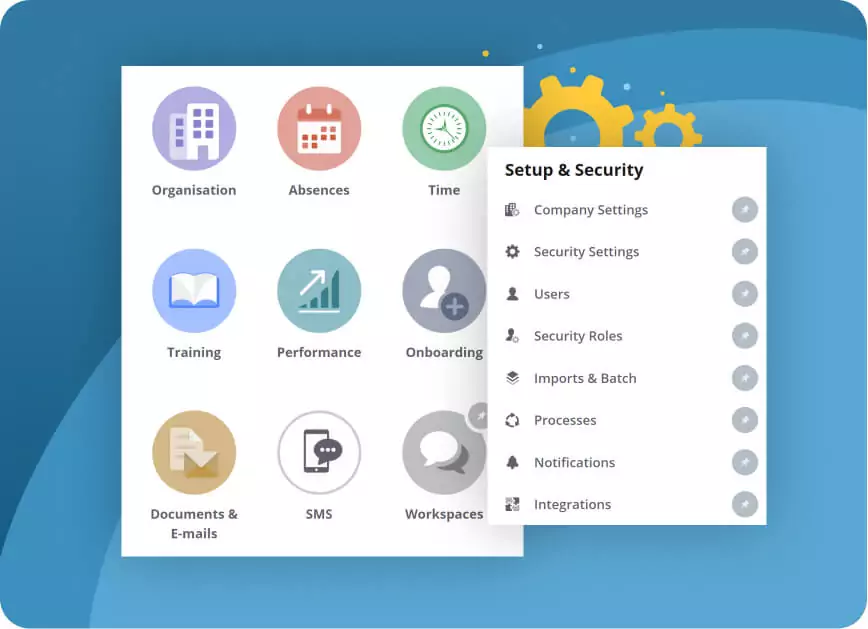

Built to put you in control

Cezanne HR automates and simplifies every aspect of HR, from recruitment, applicant tracking and onboarding through core HR admin and compliance to holiday and absence management, performance reviews and check-ins, pulse surveys, talent management and much more.

You’ll benefit from time-saving tools and easy configuration options, so you can tailor your system to reflect your way of working and company culture and branding.

See what our customers say

We knew how we needed to enhance our entire employee experience at LifeSearch, and the Cezanne HR platform has brought that vision to life.

LifeSearch

Flexible Cloud HR platform

Focus on what matters most

Cezanne HR’s human resources management software suite is designed so you can start with the modules that matter most to you and add new ones whenever you want.

Setting up new employee roles, departments, cost-centres, companies or countries is straightforward, and with new features released almost every month, you can be confident that as your requirements change, your HR software will too.

Working together

Support you can count on

Our product specialists will work with you to ensure your implementation is a success every step of the way. Once you are up and running, you’ll have 24/7 access to our online support portal and team of friendly UK-based support professionals at no extra charge.

We know how important it is that HR systems run smoothly so we are thrilled that customers consistently rate our set-up services and ongoing support as excellent.

See what customers say

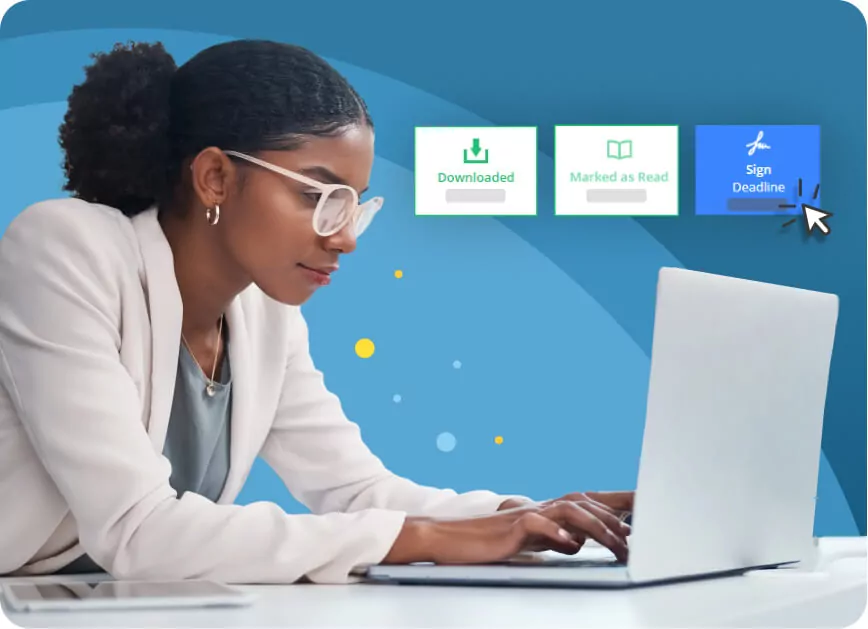

HR compliance

Sleep better at night

From document tracking and e-signatures to dedicated features for specific legislative requirements, such as recording and following up on grievance and disciplinary events, right to work evidence and mandatory training or certifications, Cezanne HR helps ensure HR compliance is an integral part of the way your organisation works.

You’ll also benefit from a single, secure source of personnel data, automated notifications that ensure key activities aren’t overlooked, and tools to help you delete or anonymise data in line with EU and UK GDPR requirements.

Multi-language, multi-country

Connect your global workforce

As a team, we have decades of experience developing robust, secure HR software and human capital management solutions for companies worldwide. We know what it takes to deliver a cloud-based HR system that really works.

With expert language translations at no extra charge, easy-to-use global configuration tools and an international customer base, Cezanne HR is a proven HR management system for any organisation looking to connect, grow and manage an international workforce.

International HRMS features

Let’s transform HR together

Cezanne HR is trusted by thousands of HR professionals to help them better manage, support, engage and connect their people. Get in touch today to learn more.

What is HR software?

HR software is a system for human resources management that streamlines HR processes, centralises and secures HR data and improves employee engagement. HR software is also referred to as HR systems, Human Resources Management Systems (HRMS) or Human Resources Information Systems (HRIS software).

HR software is designed to help HR professionals and managers to manage their workforce more efficiently and effectively. It reduces administrative overheads, improves communication between employees and managers, and provides valuable insights into workforce performance and productivity.

The HR system for the complete employee lifecycle

Everything you need, all in one place

Whether you want to speed up the hiring process, boost employee engagement, simplify performance reviews or have more time to focus on strategic HR functions, such as employee development, talent management and succession planning, Cezanne HR has the features and flexibility you need.

Best practice HR platform

Benefit from modern HR software built by experts with input from hundreds of HR professionals worldwide.

Time-saving tools

Ensure processes run like clockwork with inbuilt automation, approval workflows, notifications, calculations and more.

Expert insight

Make better decisions faster with instant online access to up-to-date reports and graphical analytics.

Easy self-service

Save everyone time and connect managers with the information they want with secure self-service from PC, tablet or mobile.

Global HRMS

Take advantage of an HR system that’s been developed from the ground up to streamline international HR.

Integrated Payroll

Outsource your UK payroll processing to our expert team and ensure your people get paid accurately every time.

HR that works better for everyone

More reasons to choose Cezanne HR

Cezanne HR combines industry expertise and best-practice thinking with Cloud and automation technologies to take the cost and complexity out of HR management software without sacrificing the sophistication, flexibility or security that today’s connected organisations demand.

Frequently asked questions about Cezanne HR

What are the key benefits of HR software?

- Significant time saving: HR software dramatically reduces administration by routing the right information to the right people at the right time.

- Improved accuracy: HR systems provide a best-practice HR framework that makes managing HR data and processes easy and effective.

- Better business decisions: HRIS provide fast, easy access to the latest information and simplify reporting, so HR and line managers can make better-informed decisions faster.

- Improved employee engagement: modern HRIS connect employees with each other and with the organisation, boosting employee satisfaction and engagement.

- Future-focused human capital management: human resources software helps HR, line managers and employees work together to agree goals, develop career opportunities and achieve outcomes that work for the employees and the business.

- Reduced data risks: paper-based HR records and excel spreadsheets are almost impossible to secure. Human resources information systems are designed to keep HR data safe.

- Easier HR compliance: HR systems help ensure key dates aren't missed and key data is easy to collect and report on.

- Greater HR agility: the best HRIS have flexibility built-in, so HR teams can respond rapidly to changing situations – whether that's growth, restructuring, expansion overseas or remote and hybrid working.

- Cost savings: by dramatically improving business efficiency and boosting employee engagement and retention, modern HR software like Cezanne HR save time and money.

What is Cezanne HR?

HR software designed to streamline HR processes, provide better HR insight, improve employee engagement and reduce data administration. Book a demo now.

Is Cezanne HR the best HR software for you?

The best HR software systems today share three key characteristics:

- They've been built to take out cost and complexity, connect employees and put HR in control.

- They provide an all-in-one HR solution that's easy to scale and flex to fit your changing needs.

- They are quick to implement, straightforward to manage and updated with new features for free on a regular basis, so you never get left behind on an out-of-date system.

With five-star reviews and a rapidly growing customer community, Cezanne HR is the best HR software for mid-sized UK and global organisations looking for a flexible HR system that is comprehensive, cost-effective, easy to manage and built for growth. To discover if Cezanne HR is the best UK HR software for you, why not read customer case studies or arrange a no-obligation online demo with one of our friendly HR software experts?

How will Cezanne HR help my organisation?

From time-saving automation and notifications to intuitive online access for employees 24/7, Cezanne HR is designed to benefit your whole organisation. You'll cut down on paperwork, boost productivity, promote engagement and deliver invaluable insight, so everyone can work smarter together.

What is the price of Cezanne HR?

Cezanne HR is provided on a subscription basis with fees paid monthly in arrears and automatically adjusted every month to match your active headcount and selected modules, so you never pay for capacity you don't need. Your monthly subscription fee covers everything needed to keep your HR software up and running safely including; hosting with AWS in a secure, high availability GDPR-compliant environment, 24/7 monitoring, unlimited data storage, backups, customer support and new features for your modules as soon as we release them.

To get your no-obligation quote, click here.

Is Cezanne HR a Cloud HR software solution?

Yes. Cezanne HR was built from the ground up as a pure Cloud HR platform. Our customers benefit from the advanced security, lower costs, and automatic updates that modern Cloud HR software provides.

How secure is my employee data?

Cezanne HR's HRM software and service are secure by design, independently certified to ISO27001 and subject to 24/7 monitoring as well as regular third-party penetration testing. Other measures we take to ensure data security include strong data encryption at rest and during transfer, advanced user authentication and authorisation, operation system hardening, and the implementation of multiple firewalls. Learn more about our security here.

Where Cezanne HR hosted?

Cezanne HR is hosted by AWS within the EEA and fully compliant with UK and EU GDPR data protection legislation. With millions of customers around the world, AWS is the leading international Cloud infrastructure provider and certified to ISO27001, SOC 1/SSAE 16 (previously SAS70), and SOC 2.

Is Cezanne HR a global HR management system?

Cezanne HR is a global HRIS platform built in the UK, but used by organisations worldwide. The HR management platform is multi-country, multi-company, multi-currency and available in 10 key languages at no extra charge. Purposely designed to flex to fit around different HR processes across different countries, Cezanne HR is used in over 120 countries worldwide, including UK, Ireland, Spain, Italy, the Netherlands, Greece, Germany, Portugal, France, Switzerland, Greece and the Nordic countries. Learn about our global HR management platform here.

Will you help me with set up?

Absolutely. We know how important it is to you to get your HRM software up and running smoothly and our consultants will work with you from day one to make sure your implementation is a success. You'll benefit from a free core HR data upload service together with expert advice and the option to select from a range of cost-effective implementation services, each of which is tailored to your specific requirements.

Do you provide support?

Yes. You'll benefit from expert support from our dedicated team of friendly UK-based consultants together with access to an online support portal packed full of expert articles and helpful 'how-to' videos.